nj employer payroll tax calculator

To qualify for Unemployment Insurance benefits you must meet all of the eligibility requirements of the New Jersey Unemployment Compensation Law. Unemployment Insurance UI is a program that gives financial support to people who lose their jobs through no fault of their own.

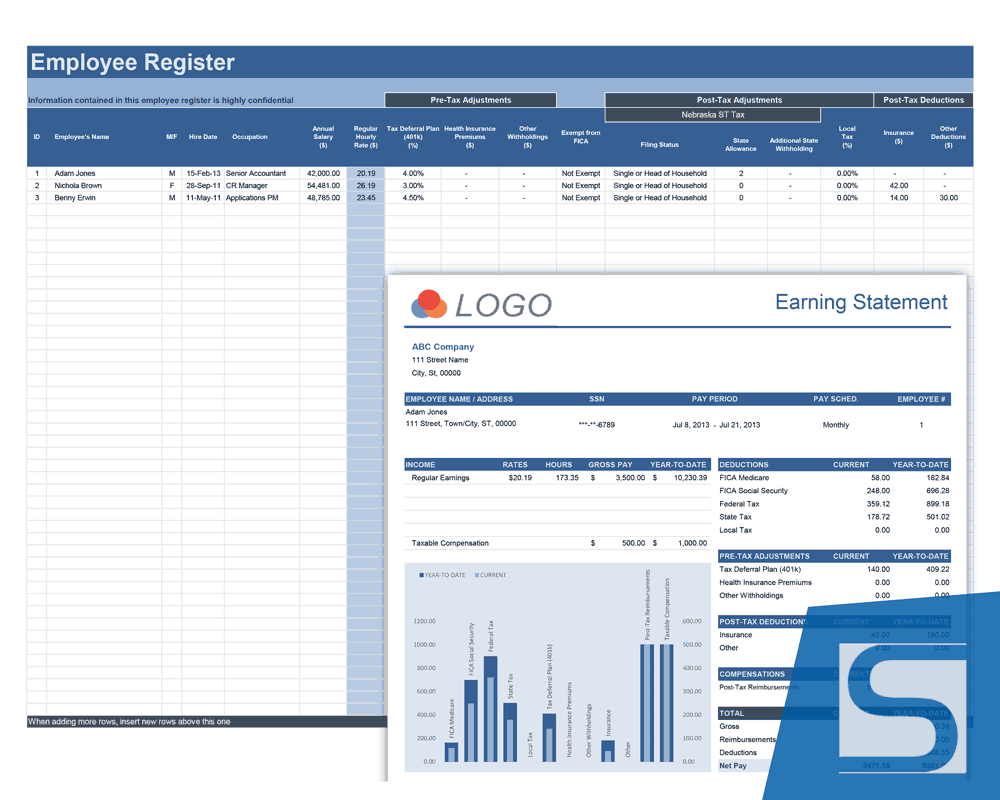

Salary Calculation Sheet Template As The Name Indicates Is A Spreadsheet That Helps Calculate Each Employ Payroll Template Spreadsheet Design Excel Shortcuts

If this is true your employer must issue you a corrected W-2.

. If your employer didnt withhold the correct amount of federal tax contact your employer to have the correct amount withheld for the future. Those who meet the requirements may receive benefits for up to 26 weeks during a one-year. Your employer might have withheld taxes but gave you an incorrect W-2.

Your employer might have just made a mistake.

The Beginner S Guide To Federal Payroll Tax Withholding Entertainment Partners

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Nanny Tax Payroll Calculator Gtm Payroll Services

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Paycheck Calculator Template Download Printable Pdf Templateroller

Payroll Calculator Free Employee Payroll Template For Excel

Surepayroll How To Calculate Payroll Taxes Youtube

Free Payroll Tax Calculator Paycheck Calculation Fingercheck

Different Types Of Payroll Deductions Gusto

Paycheck Calculator Take Home Pay Calculator

Top 6 Free Payroll Calculators Timecamp

Solved W2 Box 1 Not Calculating Correctly

Paycheck Calculator Take Home Pay Calculator

Employer Payroll Tax Calculator Incfile Com

Payroll Calculator Free Employee Payroll Template For Excel

Top 6 Free Payroll Calculators Timecamp

Top 6 Free Payroll Calculators Timecamp